The Electric Grid: America’s Engine for Growth and Green Transition

Upgrading the U.S. electric grid is increasingly vital for economic growth and reducing emissions. The shift towards electric vehicles, along with the electrification of buildings and industries, is essential for decarbonization and is gaining momentum through new incentives. Yet, this shift demands significantly more clean electricity, a need already evident in some regions. Emerging energy-intensive industries such as data centers and a revival in domestic manufacturing for advanced technologies are beginning to drive up expected electricity demand. However, the grid is lagging, with approximately 2 terawatts of clean energy stuck in interconnection queues. For instance, in Loudoun County, Virginia—a key hub for data centers—grid concerns are leading to permit denials. Enhancing our transmission capabilities is crucial for delivering growing clean electricity from producers to consumers.

Expanding Regional and Interregional Transmission to Achieve Net Zero

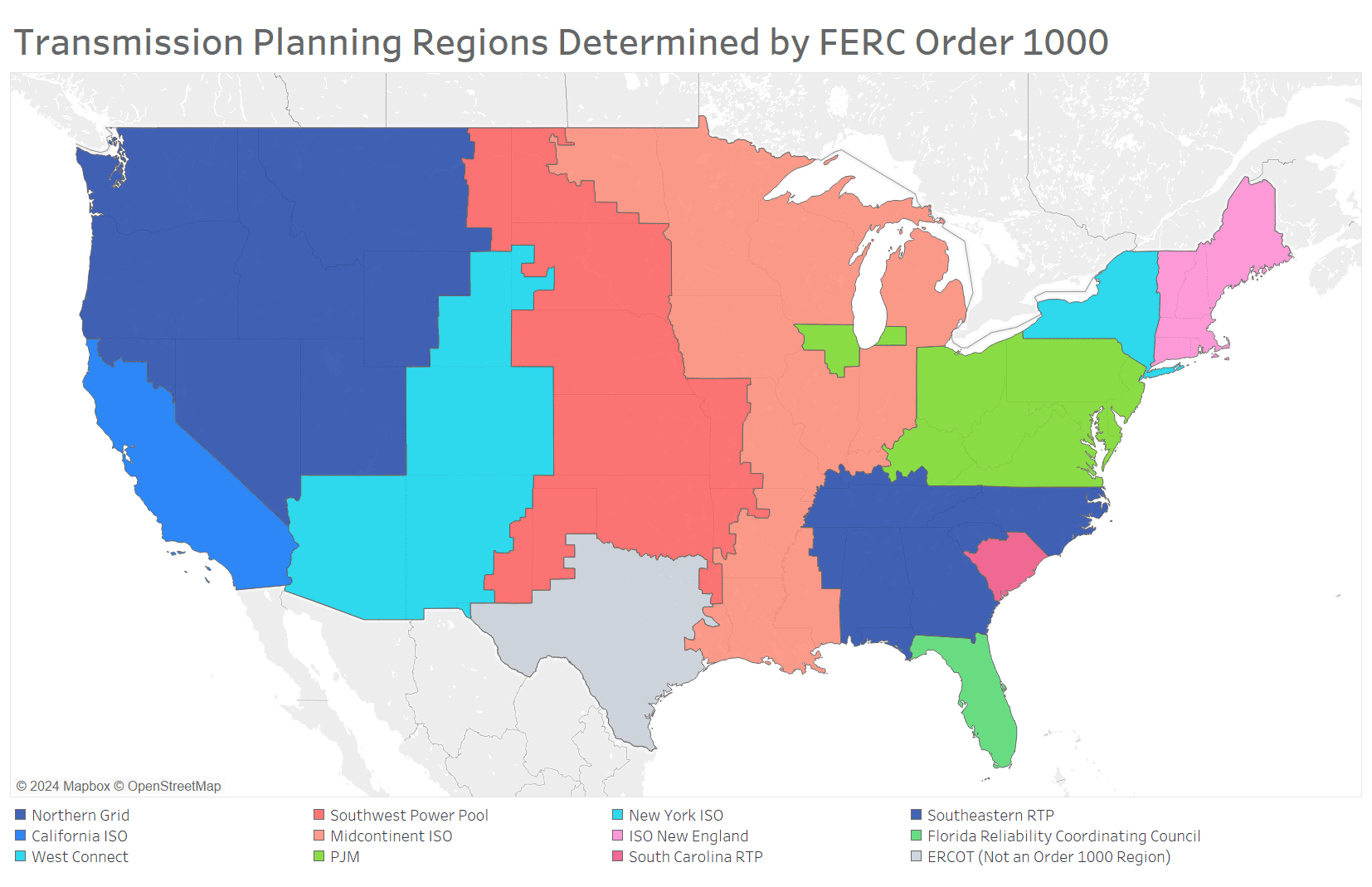

Achieving net zero requires substantially more transmission capacity, both within and between transmission planning regions. Federal Energy Regulatory Commission (FERC) policies dictate separate planning for regional and interregional transmission, both of which are essential for a reliable, affordable, and resilient carbon-free grid. Think of regional transmission (measured in terms of power capacity times distance) as the roads within a region. To expand the network, we can build more roads to increase the distance covered, and we can widen the roads—analogous to increasing the power capacity of a transmission line. Interregional transmission (often measured in terms of power capacity alone) is like a bridge between two regions—what’s most important is the number of vehicles, or in this case, the amount of electricity, that can move between regions at any moment in time.

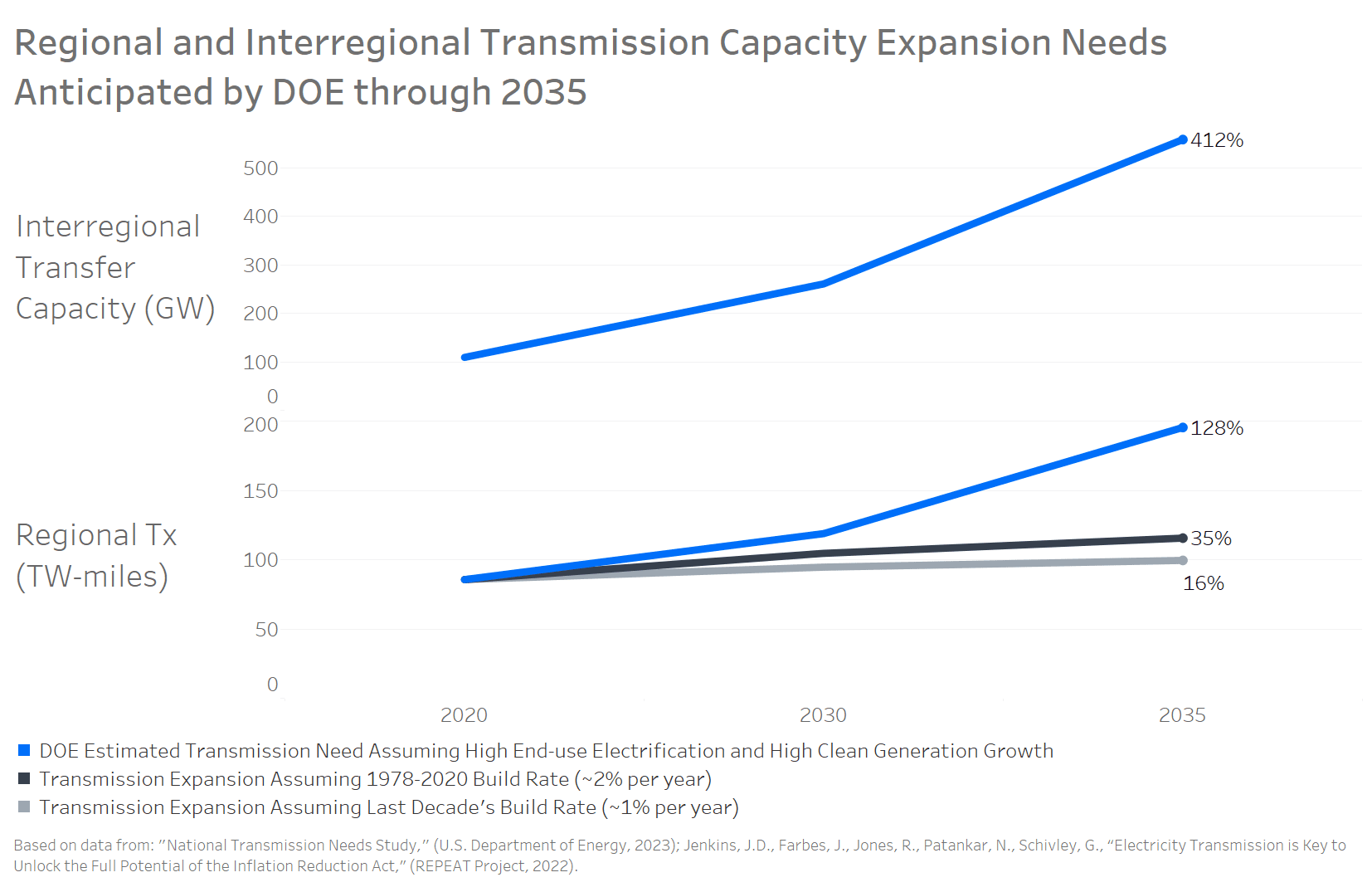

Electrification and grid decarbonization necessitate rapid growth in transmission, outstripping historical construction rates. Currently, expansion efforts are insufficient, with deployment rates declining over the past decade. The U.S. Department of Energy’s National Transmission Needs Study suggests that regional transmission might need to double by 2035 to meet ambitious decarbonization targets. By 2050, terawatt-miles may need to triple to support a clean grid amidst rising electricity demand from a decarbonizing economy. Interregional capacity may require even more aggressive growth, potentially quintupling by 2035, representing the increasing importance of being able to move electricity from parts of the country with the best renewable energy resources to distant population centers.

Dual Paths to Transmission Expansion: Boosting Current Lines and Building New Ones

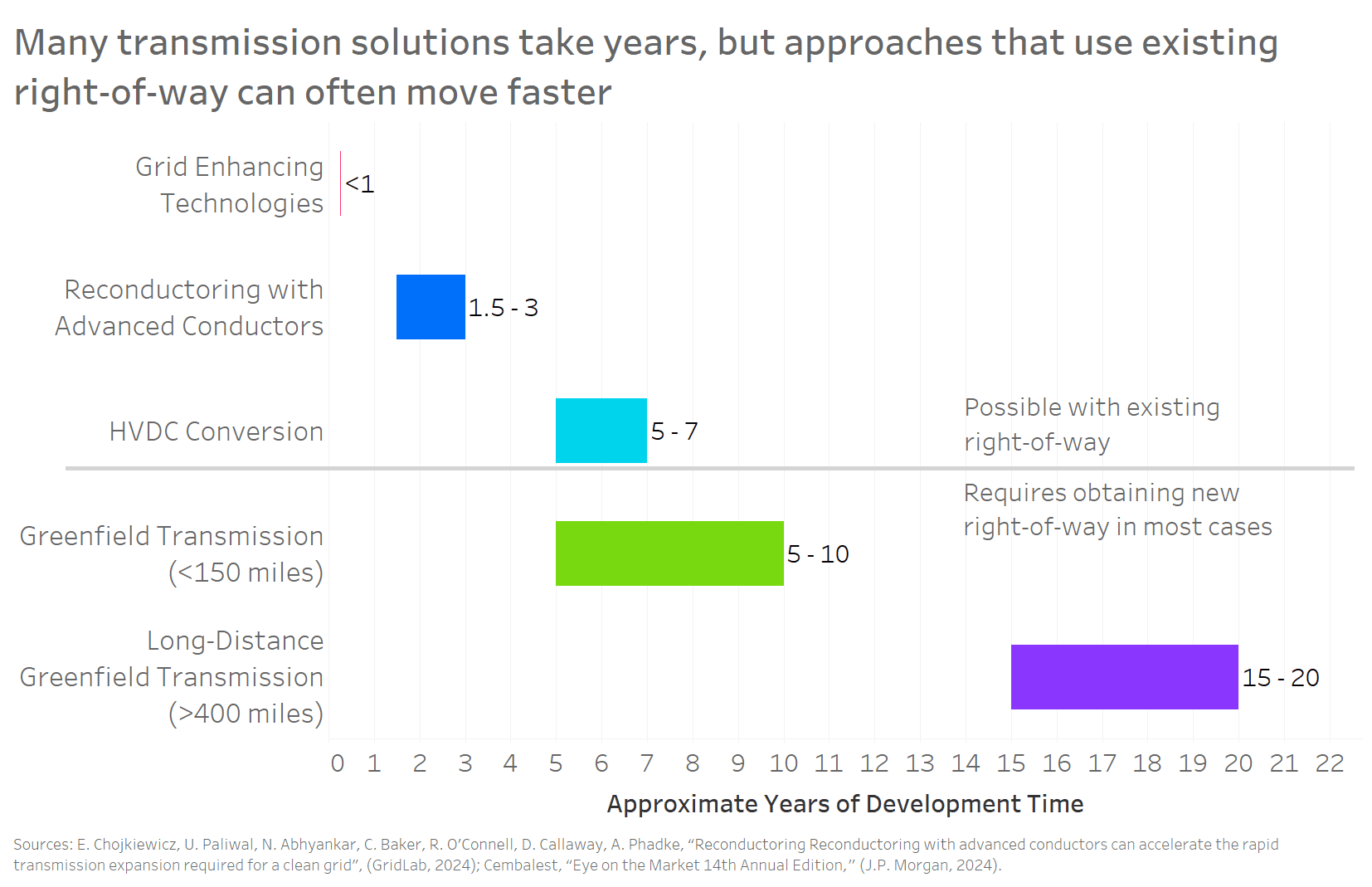

To expand transmission capacity, we can enhance existing lines and construct new ones. Enhancing existing lines is often quicker due to the lengthy process of siting, permitting, and constructing new lines, which typically involves securing new rights-of-way.

There are several methods to increase the capacity of current lines. Some notable examples include:

- Reconductoring with Advanced Conductors: This method replaces old conductors with new ones that have higher capacity for electrical current.

- Grid Enhancing Technologies (GETs): These technologies optimize electricity flow and increase the throughput of existing grid infrastructure.

- AC to DC Conversion: Converting alternating current lines to high voltage direct current (HVDC) can improve transmission efficiency and is especially advantageous over long distances.

While all these methods are valuable, advanced conductors are particularly promising. They offer a broader application potential compared to HVDC conversion and can boost transmission capacity more significantly than GETs.

Advanced Conductors: Turning Roads into Highways for Electric Current

Conductors are essential components of power lines, responsible for transmitting electricity. Most power lines used today consist of aluminum for conducting electricity, paired with steel for structural strength. Advanced conductors often use higher performing materials; for instance, replacing steel with carbon fiber, which provides strength while being lighter and less prone to expanding and sagging when hot. This allows for more aluminum conductor to be packed in, reducing the risk of sagging under heavy electrical loads and improving efficiency by decreasing line losses.

Companies like 3M, CTC Global, Southwire, and TS Conductor (a Breakthrough Energy Ventures portfolio company) offer advanced conductors that can increase capacity by double or more relative to commonly used ones. VEIR, another portfolio company, is developing a technology that could potentially increase conductor capacity by 5-10 times.

Modeling the Future: Complementary Benefits of Reconductoring and New Lines

Power sector models often leave out reconductoring as an option for expanding transmission capacity, assuming that any needs are met by new transmission development without delay. However, recent modeling highlights the significant potential of reconductoring in tandem with building greenfield transmission.

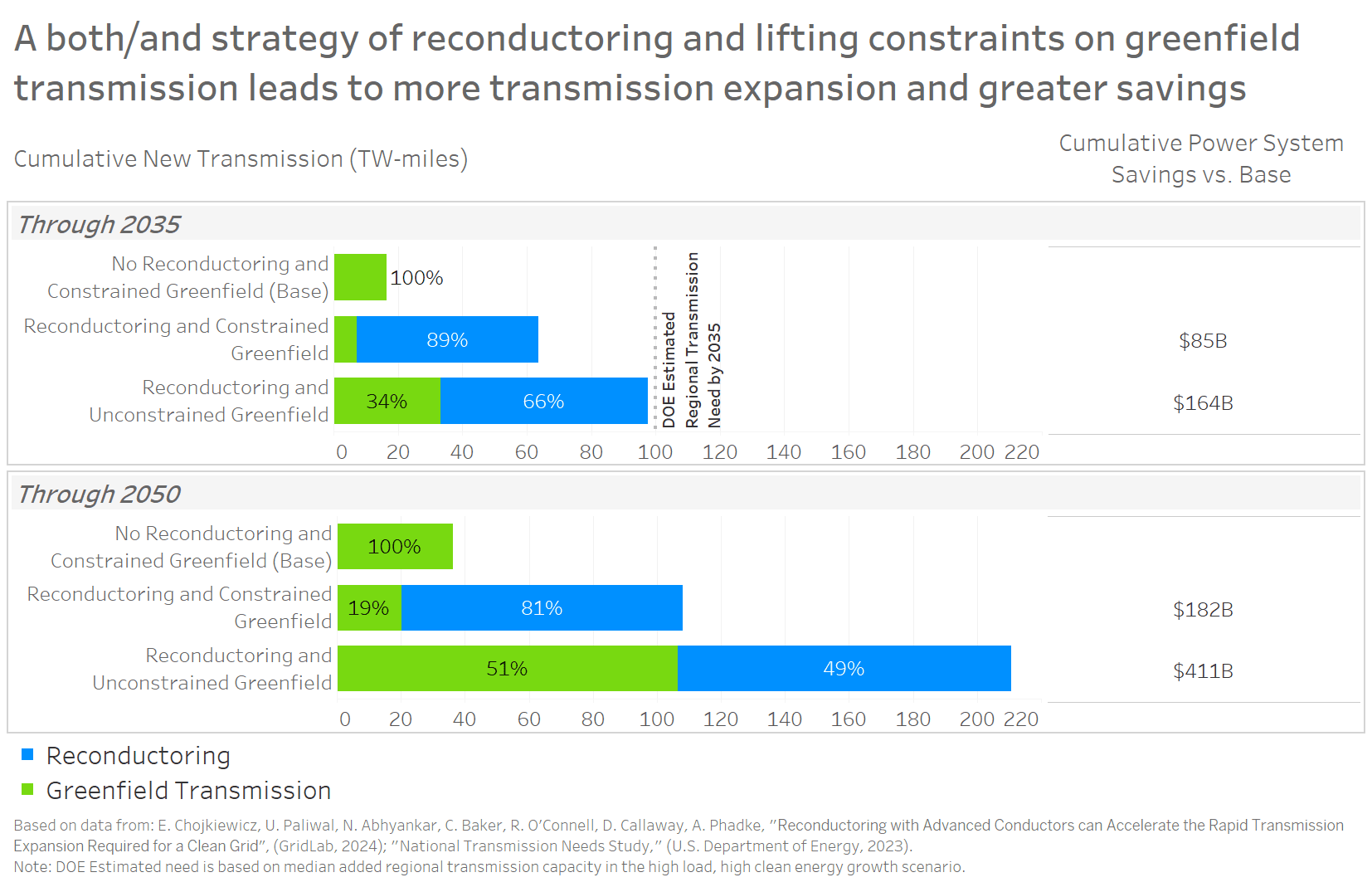

A new study by University of California, Berkeley and GridLab looked at the grid investments needed to drastically reduce power sector emissions while accommodating increased load from electrification in other sectors. The researchers then tested different transmission scenarios, adjusting the availability of reconductoring and constraints on greenfield transmission development.

In scenarios lacking widespread reconductoring and expedited greenfield development, transmission expansion is limited to only 16 TW-miles through 2035. This falls drastically short of the Department of Energy’s anticipated need for approximately 100 TW-miles of new transmission capacity over that timeframe. At that pace, maintaining momentum in clean energy deployment would become a daunting and more costly challenge.

Enabling widespread reconductoring in the study drives substantially greater transmission expansion, simultaneously reducing the costs associated with grid decarbonization. However, combining reconductoring with unconstrained greenfield development allows for the greatest added transmission capacity, nearing Department of Energy 2035 benchmarks and saving over $400 billion by 2050.

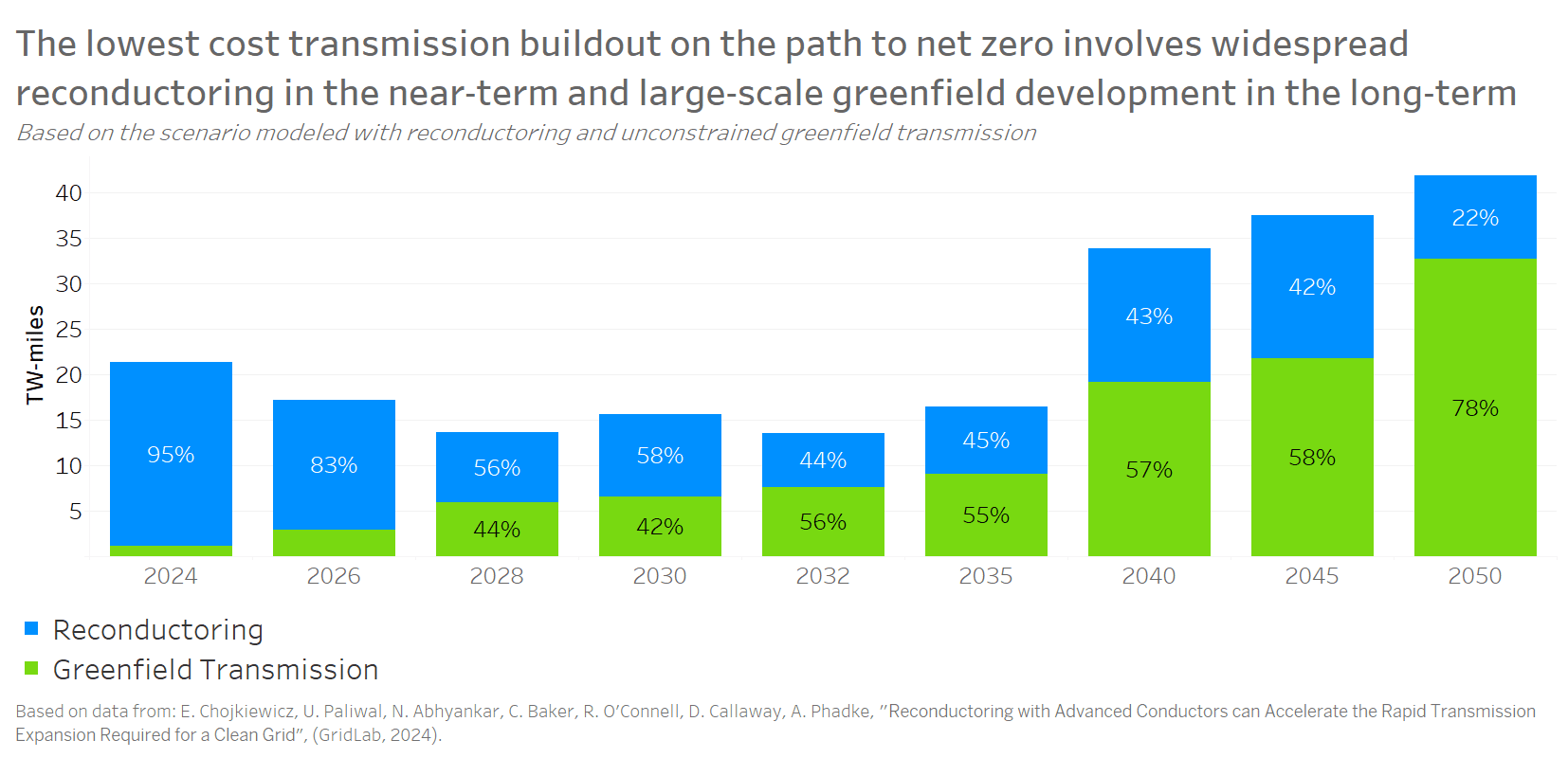

In this lowest cost scenario, reconductoring delivers most of the transmission additions through 2030. As more existing lines are retrofitted with advanced conductors, reconductoring opportunities are reduced and greenfield transmission begins to drive the majority of new capacity.

Reconductoring will be most effective within regions that already have dense transmission networks. To address the critical need for increased interregional transfer capacity, which is much less robust today, greenfield transmission will be particularly important. Any new lines can also incorporate advanced conductors from the outset.

A Both/And Strategy for Expanding Transmission

To ensure our grid evolves to accommodate a clean, net-zero economy, it’s crucial to adopt a both/and approach to transmission. This approach should promote the deployment of advanced conductors and other solutions to enhance existing lines, while also establishing a policy framework that accelerates the development of new regional and interregional transmission. Stay tuned for our upcoming post, which will explore how policies to promote reconductoring fit into this broader transmission policy strategy.