The Clean Tech Policy Impact Assessment illustrates how four big pieces of recent legislation work together to build up key clean technology supply chains in the U.S. with the potential to deliver both climate and economic benefits.

A new assessment by Boston Consulting Group (BCG) demonstrates that the U.S. has taken significant coordinated steps over the last three years toward building up new domestic clean technology industries that can both deliver long-term economic opportunity in the U.S. and drive down greenhouse gas emissions globally.

The Clean Tech Policy Impact Assessment examines how the Energy Act of 2020, the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act improve the prospects for developing U.S. supply chains across 10 critical clean technologies, ranging solar and electric vehicles to more emerging solutions such as clean hydrogen and direct air capture.

The assessment builds on previous work by BCG which investigated the long-term climate and economic potential for each technology. BCG previously found that with smart policy and targeted investments, these clean technologies could not only unlock about 30 gigatons of global emissions reductions per year by mid-century but also a growing global market opportunity that could rival the scale of incumbent energy markets today.

Now, BCG’s new analysis illustrates how the four big pieces of recent legislation help realize this opportunity and together form the foundation of an ambitious clean industrial strategy to accelerate U.S. leadership in many of the critical technologies we need to reach net zero. Collectively, the federal funding supported by these policies could catalyze hundreds of billions in private investment in clean technologies over the next eight years.

All countries have a role, but leadership will be rewarded

Many countries will play a significant role in building these global industries, buying down costs, and deploying the technologies around the world to drive down greenhouse gas emissions. But countries that lead in accelerating the development of clean technologies could see substantial economic rewards and jobs.

For the U.S., significant opportunities exist where it can leverage its leading R&D capabilities, use its abundant natural resources (especially renewables and carbon storage), and transfer technical expertise from legacy automotive, oil & gas, and nuclear industries to emerging technologies.

A clean industrial strategy means a focus on supply chains

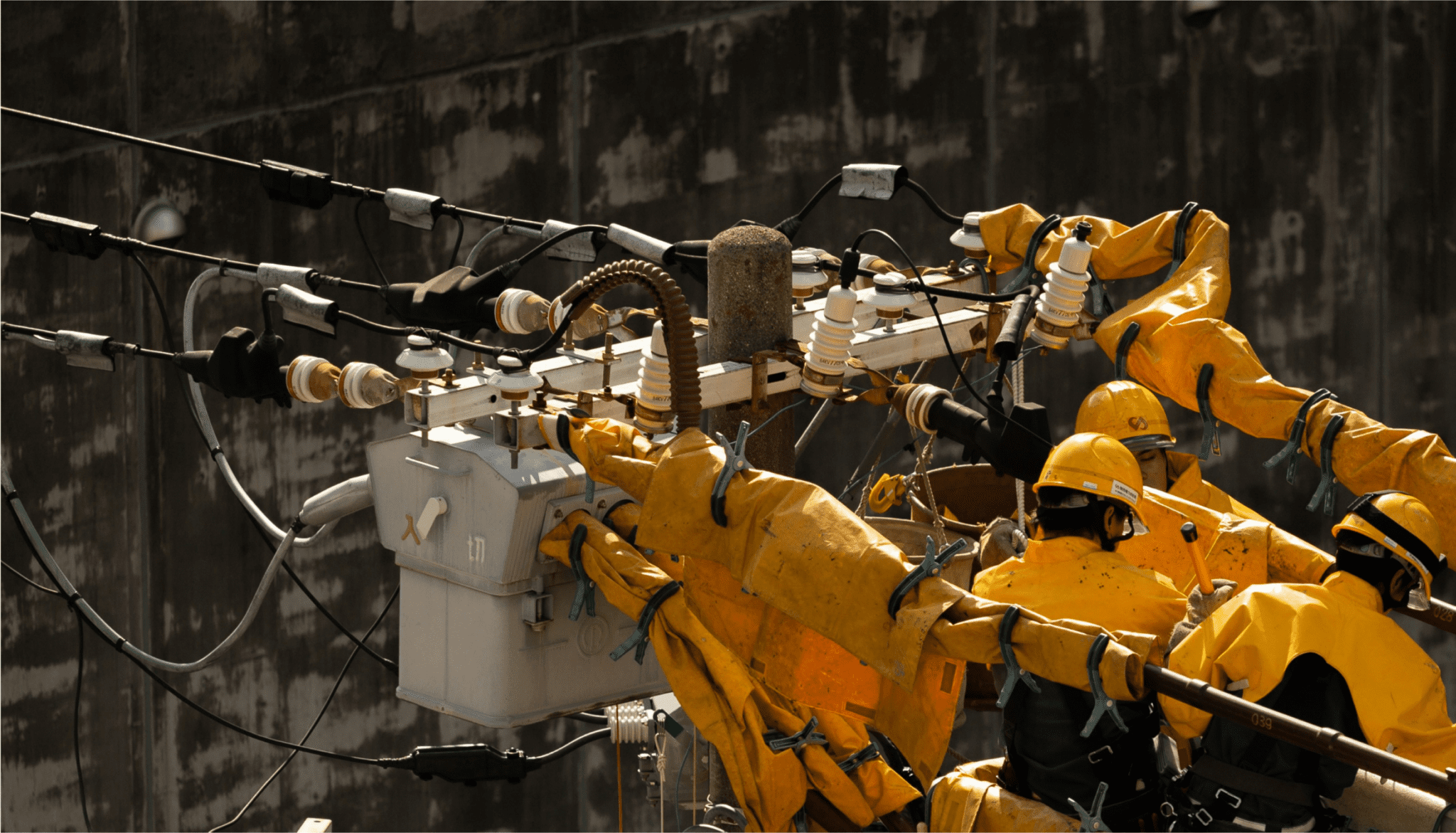

Building up and maintaining new clean technology industries in a competitive global market and doing so at the rapid pace needed to achieve climate goals requires strategic public and private investment, coordination, and supporting policy across the supply chain. Successful technology adoption only happens at scale once the supporting supply chains can be developed, spanning economic activities such as raw material extraction and processing, equipment manufacturing, transport and storage, and end-product offtake and use. Bottlenecks at any point can slow the deployment of clean technologies, making it harder to drive down emissions and creating obstacles for new companies to compete.

These challenges are especially present for clean hydrogen, an essential tool for meeting climate goals. BCG sees clean hydrogen contributing to gigatons of annual emissions abatement annually by mid-century and an over $4T cumulative global market between now and 2050. But the technology is still in its early stages today.

We often think of scaled-up electrolyzer manufacturing as being key to developing a mature clean hydrogen economy. But electrolyzers themselves typically require critical mineral inputs, and running them competitively to produce clean hydrogen will rely on access to plentiful emissions-free electricity that can be cheaply delivered from power generators like solar or wind farms to the electrolyzer.

At the same time, a robust project development ecosystem will need to be developed to finance and build electrolyzer plants in the highest-value locations. Transport and storage infrastructure will have to be in place to connect supply and demand. And committed offtakers will need to step forward to buy the clean hydrogen molecules and use them in productive applications such as chemical production, steel making, or heavy or-long-distance transport.

Emerging climate technologies like clean hydrogen need to be scaled in record time

For the world to meet its climate goals, emerging technologies like clean hydrogen need to be scaled up more rapidly than the pace at which many other technologies have been able to come to market in the past. Recognizing both the climate imperative and economic opportunity, an increasing number of countries are developing clean hydrogen strategies.

The U.S. Department of Energy recently set a target of producing 10 million metric tons (Mt) of clean hydrogen annually by 2030, up from near-zero today. A recent analysis by Rhodium Group showed that if electrolyzer installed capacity in the U.S. grows 50% faster than utility-scale solar capacity did in its best 10-year period, reaching 21 GW by 2030, the U.S. would still only produce about 3 Mt per year. National 2040 and 2050 goals may be easier to reach once the industry scales up over the next decade, but it is clear that an unprecedented pace of deployment is needed.

In the early stages of technology adoption, growth can be slow and unsteady before it takes off. Because many of hydrogen’s applications in a decarbonized energy system are either nascent or completely new, achieving rapid growth could be significantly more challenging than for solar and wind, which were able to immediately sell into a mature market for electricity with an existing transmission network (though transmission is in urgent need of expansion and modernization).

In contrast, clean hydrogen faces simultaneous uncertainty in supply, demand, and infrastructure for transport and storage. All must be ramped up in parallel. Historically, exceptionally high rates of adoption for new technologies have only been achieved when government de-risks private investment with policy support on both the supply and demand sides.

Recent U.S. legislation is accelerating investment across the clean hydrogen supply chain

With all these complexities in mind, it’s clear how tall a task it is to craft policy that comprehensively enables clean hydrogen to scale. However, BCG’s assessment shows how the four big pieces of recent legislation have done just that by providing strategic support to clean hydrogen across the supply chain. This enables the rapid growth that will be needed over the next few decades to achieve climate goals and ensure technology and economic leadership.

Together, these laws are expected to drive an extra $50 billion in investment across the supply chain and purchases of clean hydrogen through 2030, creating up to tens of thousands of jobs along the way.

In the absence of recent legislation, clean hydrogen demand in the U.S. was expected to be negligible. Yet policy-catalyzed investment now could increase annual volumes of clean hydrogen by over 20 times by the end of the decade, making it competitive with emissions-intensive hydrogen and making possible numerous use cases from fertilizer production to steel and transportation fuels.

Clean hydrogen is just one example—findings for it mirrors those for many of the other emerging technologies covered in the assessment. The progress of the last few years is real. New U.S. policies will accelerate the development and adoption of critical clean technologies, bringing us closer to meeting our climate goals and positioning the U.S. for leadership in the clean industries of the 21st Century. We now need to set our sights on timely and effective policy implementation to make the most of this new opportunity.