As we look back at the last few years of climate action, it is clear that US efforts are already creating the foundation for sharp emission cuts by 2035 and delivering major economic benefits today. In the last year alone, clean energy companies have announced:

- 170,606 new clean energy jobs

- 272 clean energy projects in 44 states

- $278 billion in new private sector investments

This new production capacity will deploy clean energy faster and at a greater scale nationwide. As it turns out, a majority of the new jobs and projects are located in red states, showing how bipartisan climate solutions can be.

New research also suggests that US leadership in clean technology will create spillover climate and economic benefits. Rhodium Group concludes that US investments will drive down costs for emerging technologies like clean hydrogen, sustainable aviation fuel, and direct air capture, thus spurring more deployment (and more reductions) internationally. And Boston Consulting Group concludes that the US already is, or can be, a leader in the race to lead the clean tech market—which would pay economic dividends.

However, all this good news is dampened by one key source of CO2 we’re ignoring.

We need to account for emissions we import.

This might come as a surprise, but when the United States (and many other countries) calculates its emissions, it doesn’t include emissions from the creation of imported goods. That’s because those emissions are technically counted in the other country that created the product, which isn’t always fair if some countries produce and export much more than they consume.

Consider the production of a car. A new gas-powered vehicle can emit 46 metric tons of CO2 on average over ten years. If manufactured domestically with American steel, we are already counting the steel and auto manufacturing emissions. But if a car is manufactured in Japan using Chinese steel, then imported to the US, the emissions from its entire production have historically been overlooked, leaving us with an incomplete picture. Same story with buildings. We could be constructing energy-efficient structures to cut energy use, yet if we import cement, we typically aren’t capturing those emission impacts.

The carbon emissions associated with the production of materials such as raw steel and cement is called “embodied carbon." When we ignore embodied carbon in imports, it’s called a “carbon loophole,” and it accounts for nearly a quarter of all greenhouse gas emissions.

The carbon loophole undermines our progress.

As Breakthrough Energy’s experts on embodied carbon and trade, we think about this problem a lot.

Not accounting for embodied carbon in imports undermines the investments we're making at home. Many manufacturing industries have low margins and significant exposure to competition among global trading partners. Domestic industries have less incentive to get cleaner if their competition isn’t doing the same—they’d be undercut.

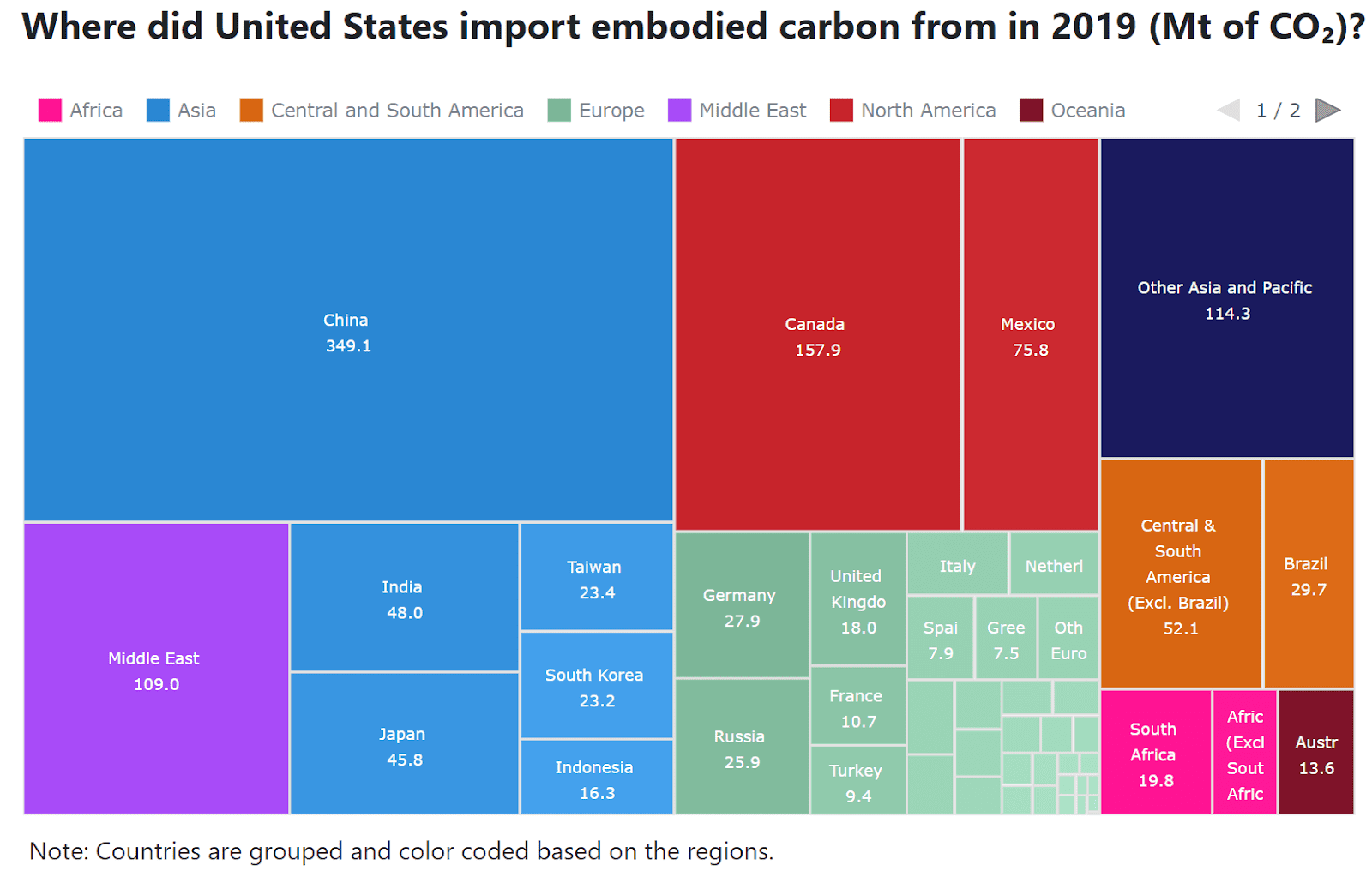

That’s why heavy industry will have a harder time decarbonizing until we account for embodied carbon in traded products. While China, Canada, and Mexico are the top three sources of embodied carbon imported into the US, this is a global problem.

First, we need better data.

To address embodied carbon, we need to know how much of it we’re generating through our imports.

Breakthrough Energy-funded Carbon Voyage is working to solve that problem by building a one-stop shop for data visualization on embodied carbon in traded products. Having better analytical tools like this enables policymakers to design the most effective, data-driven solutions.

Carbon Voyage also starts to explore how the carbon intensity of various products compares from country to country, which is exactly the information we need to know to understand how to make a difference. That’s why a bipartisan group of senators has sponsored the PROVE IT Act, which would direct the Department of Energy to study the emissions intensity of US products relative to those produced in other countries, building on the work by Carbon Voyage.

Then, we need thoughtful policy.

With better data, we can start thinking about which policies we should put into place to align our climate and trade goals. We should aim to level the playing field so domestic and foreign producers are all incentivized to decarbonize, creating a race to the top. Ultimately, the first-best option is an international emissions intensity standard for specific industries and global collaboration to meet the standard. But immediate agreement will be difficult, so we’re likely to start with other policy paths. One option is for individual countries to charge imported products based on their carbon intensity. Another is bilateral or multilateral trade agreements. Lastly, climate alliances can begin to create cooperation around climate and trade. Such solutions not only support US businesses which are already producing many lower carbon intensity products, but also reduce emissions embodied in everything from buildings to vehicles.

By tackling emissions and supporting American business at the same time, climate-aligned trade policy, specifically an import fee, has broad bipartisan support. In fact, senators on both sides of the aisle are planning to propose their own versions.

Conclusion

In the last few years, investments in clean technology have paved the way for major emissions reductions and lowered costs. That not only helps the US reach our goals, but drives deployment globally, bolsters US leadership, and supports American jobs.

However, there’s more that future US policy must do to reduce emissions globally. Better data is the first step. Accounting for the emissions from embodied carbon in trade will only accelerate our collective climate progress. This will ensure domestic industries can capitalize on their clean investments faster and shed light on manufacturing emissions abroad to unlock resources for clean technology investments around the world.